Newsroom

Read the latest updates from the Compound team including company, product, and partnership announcements.

2024 40 Under 40 Spotlight: Kristin Carter, 2018

Compound Planning Adds 6 Advisors Who Previously Managed Over $1 Billion

Compound Planning adds six advisors to its digital family office

Compound Planning Adds 15 Advisors in First Weeks of 2024

The Federal Reserve: Challenges Past and Present

Compound Planning continues momentum, adding 6 more experienced advisors

Blending High-Tech Tools with Traditional Advisory to Master Wealth Management and Demystify Financial Planning

$1.4bn Compound Planning adds nine advisors from Personal Capital

Compound Planning hails pivotal hire of nine financial advisors

Better Together: Consolidation Within The Family Office Industry

Compound Planning Solidifies Its Position as a Tech-Powered Leader in Wealth Management, Adding 9 Advisors to Team

Compound Planning expands advisor recruiting team with two key hires

Kristin Carter, CPA joins Compound Planning as Head of Tax Advisory

Compound Planning recruits Long Tran, adds 10th advisor of the year

Choosing the Right Financial Adviser: Fiduciary vs. Non-Fiduciary

Recruitment Roundup: Dynasty, Cetera, Compound And More

Compound Merges with Alternativ Wealth

Alternativ and Compound Merge to Form $1.1B+ RIA

Two RIAs merge into $1.1 billion digital family office

Introducing Compound Planning

Compound is compounding

Compound and Alternativ Wealth merge to form $1B+ digital family office

Embracing Complexity and Illiquidity: The Power of Alternatives in Today's Environment

Kyle Rudduck Joins Compound as Principal Wealth Advisor

Alternativ raises $10 million as digitally native RIAs pick up steam

Lance Lehman Recently Attended Investments & Wealth Institute's Annual Conference

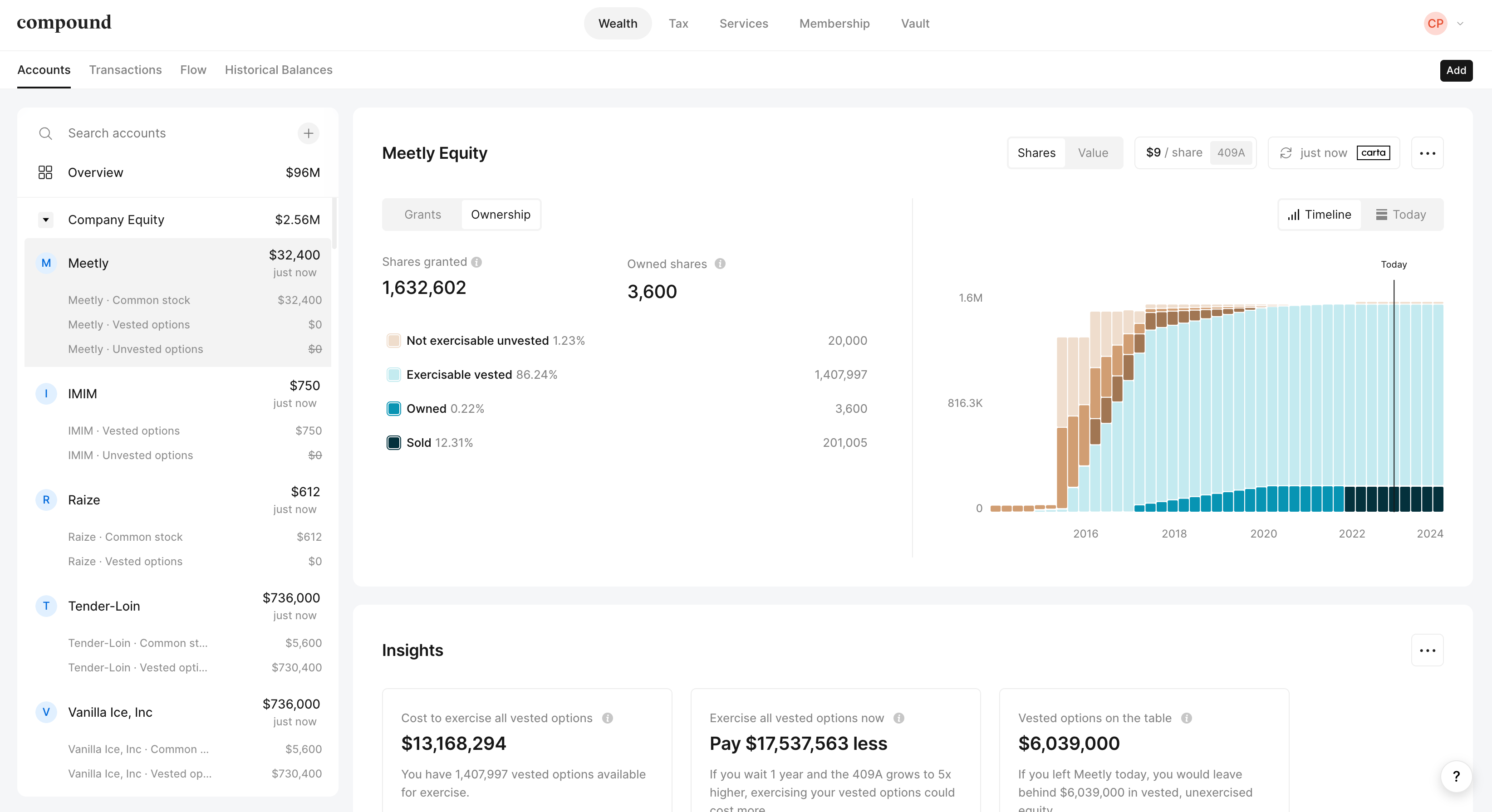

Announcing the official Carta and Compound integration

Tim Hamilton joins as Managing Director

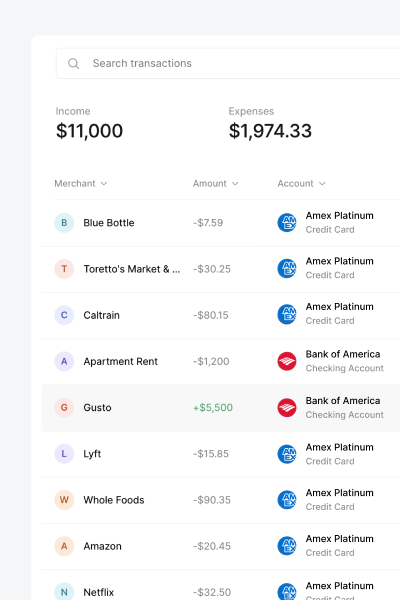

Introducing Transactions

Introducing Secondary Market Research

Compound Services

Compound Personal Cash Management

How Compound is supporting you during these uncertain times

Introducing Fixed Income Portfolios

Introducing 529 Plans

Introducing Donor Advised Funds

Introducing Personal Insurance

Introducing Revocable Trusts

Introducing Equity Modeling

Welcoming Lance Lehman as Vice President

Introducing Startup-Backed Lending

Introducing Irrevocable Trusts

Introducing Vault

Access alternative investments on Compound

Introducing Compound

Here’s how to protect your equity if you’ve been laid off

Startup risk gets riskier

Start-Up Equity Is a Great Retirement Plan, if You Can Pull It Off